Case Study

Demand Forecasting for Manufacturing with Real-Time Demand Visibility

Overview

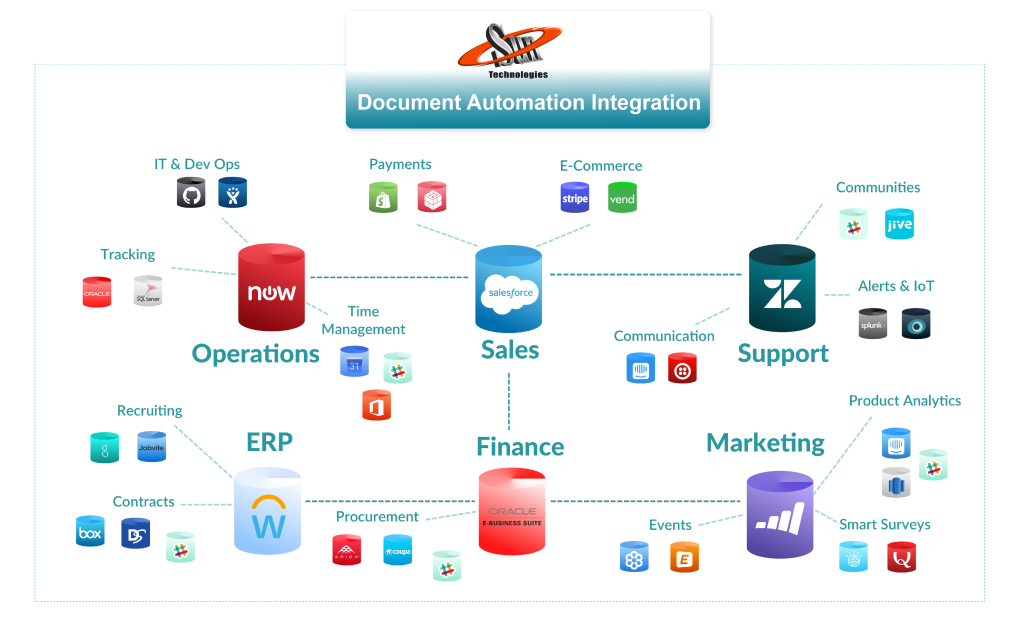

For manufacturers, the ability to fulfill demand into the future is one of the top priorities for the operations managers. However, it still remains a challenge to see the future demand in a manner that aids the manufacturing process. Using Salesforce, manufacturers can only document or identify details of any specific order in the pipeline.

Ideally, manufacturers also need to see the material that goes into an order and the status of their procumbent to execute the order. A typical Salesforce-based system would not help look into the concerns of production demand. It would only consider the items included on a completed Sales Order, which does not give an accurate picture of the cycle time. An accurate view of the cycle time is, therefore, essential to predict the amount of time required for a process to produce one unit.

Our Solution

- A cloud-driven self-service feature makes it very easy for employees to upload data remotely

- Managers can see the gaps in the supply chain in advance to make timely adjustments

- A unified view of the supply chain brings the ability to anticipate shifts in demand and adjust production and inventory levels accordingly

- Material forecasting based on the demand helps identify potential supply disruptions or quality issues early

- It helps managers to make alternative sourcing or contingency plans for sourcing of raw materials

- A forecasting dashboard makes it easy to analyze lead times of raw materials and components ordered to fulfill the production demand

- Forecasts on lead time variability and potential delays helps managers plan production schedules and buffer inventory levels

- Forecasts on labor requirements can be made using historical data and project-based estimations fed into the system by managers

- Based on past supplier experience and logistical experience managers can rate vendors

- Easily create models to analyze this historical data and detect patterns that indicate future supply chain gaps

- Feed real-time logistical tracking data into the system to monitor shipments and address any transportation-related gaps

Challenges

- It was a challenge to determine how many labor hours would be required to fulfill each SKU in the demand pipeline

- to The Standalone Salesforce dashboards are unable to provide forecasts at the account, product, or territory level

- The decision-makers in the organization were unable to see data relevant to their objectives

- Forecasts of parameters such as quotes, orders, account opportunities, contracts, etc., were not available

- Legacy systems are unable to fetch external data into Salesforce to create comprehensive forecasts

- Some SKUs have short lead times, making it crucial to have real-time or near-real-time demand forecasting

- Existing systems were unable to flag unreliable suppliers or any other disruptions in the supply chain

- Capturing data related to regulations, customs, and market conditions in different regions was not possible

How we Can Help

- We can build and implement a Machine Learning Prediction Model based on historical data, supply chain data, and other 3rd party data

- Build models to predict demand based on calculations on the lead times of the suppliers and logistics partners

- Create different tables and tranches to store data for each SKU separately and capturing the entire production cycle

- Integrate Machine Learning Models to use each SKU production-cycle data for building multiple forecasts

- Capture data by monthly and weekly inventory demand by individual products, raw materials, suppliers, etc.

The Impact

- Operations Managers can save 30 hours of production data entry tasks

- Automated data processing saves 200 man-hours of effort in reporting

- Data-grounded predictive analytics on inventory requirement into the future

- Automated Inventory optimization helps prevent unnecessary overstocking

- SKU-wise and location-wise pricing optimization can be done in a few clicks

BFSI Case Studies: Discover the Top Applications of Contract AI in Banking and Insurance Companies

Discover the Key Benefits Unlocked by Global BFSI Leaders.